While I could have run this in Excel or R, I decided to write a simple Pig job to determine the maximum, minimum and average costs by plan for each state. I also then calculated the variance and standard deviations.

/**

* healthcareCosts

*/

/**

* Parameters - set default values here; you can override with -p on the command-line.

*/

%default INPUT_PATH '/Users/davidfauth/healthcareCosts/QHP_Individual_Medical_Landscape.csv'

%default OUTPUT_PATH '/Users/davidfauth/MortarHealthCareCostsOut'

%default OUTPUT_PATH_PLANDELTAS '/Users/davidfauth/MortarHealthCareCostsOut/PlanDeltas'

%default OUTPUT_PATH_PLANSTANDARD '/Users/davidfauth/MortarHealthCareCostsOut/PlanStandard'

/**

* User-Defined Functions (UDFs)

*/

-- Load the input data from the CSV file

raw_data = LOAD '$INPUT_PATH'

USING org.apache.pig.piggybank.storage.CSVExcelStorage(',', 'NO_MULTILINE', 'NOCHANGE', 'SKIP_INPUT_HEADER')

AS (State:chararray,

County:chararray,

MetalLevel:chararray,

IssuerName:chararray,

PlanMarketingName:chararray,

PlanType:chararray,

RatingArea:chararray,

PremiumAdultIndividualAge27:double,

PremiumAdultIndividualAge50:double,

PremiumFamily:double,

PremiumSingleParentFamily:double,

PremiumCouple:double,

PremiumChild:double);

-- Limit to sa subset of data

noCurrencySymbol = FOREACH raw_data GENERATE State as newState,

County as newCounty,

MetalLevel as newMetalLevel,

PremiumAdultIndividualAge27 as newPremiumAdultIndividualAge27,

PremiumAdultIndividualAge50 as newPremiumAdultIndividualAge50,

PremiumFamily as newPremiumFamily,

PremiumSingleParentFamily as newPremiumSingleParentFamily,

PremiumCouple as newPremiumCouple,

PremiumChild as newPremiumChild;

/* Group together identical tuples */

PlansByMetalLevel = GROUP noCurrencySymbol BY (newMetalLevel, newState);

--calculate Max, Min and Avg costs

costsByPlansPAA27 = FOREACH PlansByMetalLevel GENERATE FLATTEN(group),

COUNT(noCurrencySymbol) as planCount,

AVG(noCurrencySymbol.newPremiumAdultIndividualAge27) as avgPremiumAdultAge27,

MIN(noCurrencySymbol.newPremiumAdultIndividualAge27) as minPremiumAdultAge27,

MAX(noCurrencySymbol.newPremiumAdultIndividualAge27) as maxPremiumAdultAge27,

AVG(noCurrencySymbol.newPremiumAdultIndividualAge50) as avgPremiumAdultAge50,

MIN(noCurrencySymbol.newPremiumAdultIndividualAge50) as minPremiumAdultAge50,

MAX(noCurrencySymbol.newPremiumAdultIndividualAge50) as maxPremiumAdultAge50,

AVG(noCurrencySymbol.newPremiumFamily) as avgPremiumAdultAgePFAM,

MIN(noCurrencySymbol.newPremiumFamily) as minPremiumAdultAgePFAM,

MAX(noCurrencySymbol.newPremiumFamily) as maxPremiumAdultAgePFAM,

AVG(noCurrencySymbol.newPremiumSingleParentFamily) as avgPremiumAdultAgePSPFAM,

MIN(noCurrencySymbol.newPremiumSingleParentFamily) as minPremiumAdultAgePSPFAM,

MAX(noCurrencySymbol.newPremiumSingleParentFamily) as maxPremiumAdultAgePSPFAM,

AVG(noCurrencySymbol.newPremiumCouple) as avgPremiumAdultAgePC,

MIN(noCurrencySymbol.newPremiumCouple) as minPremiumAdultAgePC,

MAX(noCurrencySymbol.newPremiumCouple) as maxPremiumAdultAgePC,

AVG(noCurrencySymbol.newPremiumChild) as avgPremiumAdultAgePCh,

MIN(noCurrencySymbol.newPremiumChild) as minPremiumAdultAgePCh,

MAX(noCurrencySymbol.newPremiumChild) as maxPremiumAdultAgePCh;

--calculate deltas

deltasByPlan = FOREACH costsByPlansPAA27 GENERATE newMetalLevel, newState,

avgPremiumAdultAge27 - minPremiumAdultAge27 as deltaMinAvgAge27,

avgPremiumAdultAge50 - minPremiumAdultAge50 as deltaMinAvgAge50,

avgPremiumAdultAgePFAM - minPremiumAdultAgePFAM as deltaMinAvgAgePFAM,

avgPremiumAdultAgePSPFAM - minPremiumAdultAgePSPFAM as deltaMinAvgAgePSPFAM,

avgPremiumAdultAgePC - minPremiumAdultAgePC as deltaMinAvgAgePC,

avgPremiumAdultAgePCh- minPremiumAdultAgePCh as deltaMinAvgAgePCh;

-- calculate variance and Standard Deviations

mean = foreach PlansByMetalLevel {

sum27 = SUM(noCurrencySymbol.newPremiumAdultIndividualAge27);

sum50 = SUM(noCurrencySymbol.newPremiumAdultIndividualAge50);

sumPFAM = SUM(noCurrencySymbol.newPremiumFamily);

sumPSPFAM = SUM(noCurrencySymbol.newPremiumSingleParentFamily);

sumPC = SUM(noCurrencySymbol.newPremiumCouple);

sumPCh = SUM(noCurrencySymbol.newPremiumChild);

count = COUNT(noCurrencySymbol);

generate flatten(noCurrencySymbol), sum27/count as avg27, sum50/count as avg50,

sumPFAM/count as avgPFAM, sumPSPFAM/count as avgPSPFAM, sumPC/count as avgPC,

sumPCh/count as avgPCh, count as count;

};

tmp = foreach mean {

dif27 = (newPremiumAdultIndividualAge27 - avg27) * (newPremiumAdultIndividualAge27 - avg27) ;

dif50 = (newPremiumAdultIndividualAge50 - avg50) * (newPremiumAdultIndividualAge50 - avg50) ;

difPFAM = (newPremiumFamily - avgPFAM) * (newPremiumFamily - avgPFAM) ;

difPSPFAM = (newPremiumSingleParentFamily - avgPSPFAM) * (newPremiumSingleParentFamily - avgPSPFAM) ;

difPC = (newPremiumCouple - avgPC) * (newPremiumCouple - avgPC) ;

difPCh = (newPremiumChild - avgPCh) * (newPremiumChild - avgPCh) ;

generate newMetalLevel, newState, count, dif27 as dif27,

dif50 as dif50, difPFAM as difPFAM, difPSPFAM as difPSPFAM, difPC as difPC, difPCh as difPCh;

};

grp = group tmp by (newMetalLevel, newState);

standard_tmp = foreach grp generate flatten(tmp), SUM(tmp.dif27) as sqr_sum27, SUM(tmp.dif50) as sqr_sum50,

SUM(tmp.difPFAM) as sqr_sumPFAM, SUM(tmp.difPSPFAM) as sqr_sumPSPFAM, SUM(tmp.difPC) as sqr_sumPC,

SUM(tmp.difPCh) as sqr_sumPCh;

standard = foreach standard_tmp generate newState, newMetalLevel,

sqr_sum27 / count as variance27, SQRT(sqr_sum27 / count) as standard27,

sqr_sum50 / count as variance50, SQRT(sqr_sum50 / count) as standard50,

sqr_sumPFAM / count as variancePFAM, SQRT(sqr_sumPFAM / count) as standardPFAM,

sqr_sumPSPFAM / count as variancePSPFAM, SQRT(sqr_sumPSPFAM / count) as standardPSPFAM,

sqr_sumPC / count as variancePC, SQRT(sqr_sumPC / count) as standardPC,

sqr_sumPCh / count as variancePCh, SQRT(sqr_sumPCh / count) as standardPCh;

distinctStandard = DISTINCT standard;

-- remove any existing data

rmf $OUTPUT_PATH;

-- store the results

STORE costsByPlansPAA27 INTO '$OUTPUT_PATH' USING PigStorage('|');

STORE deltasByPlan INTO '$OUTPUT_PATH_PLANDELTAS' USING PigStorage('|');

STORE distinctStandard INTO '$OUTPUT_PATH_PLANSTANDARD' USING PigStorage('|');

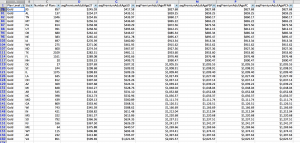

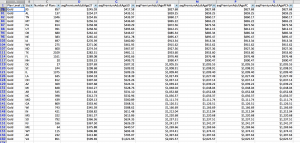

For Gold plans, Virginia is again between two and three times (2-3X) more expensive to buy insurance.

Again, Virginia’s variance on the bronze plans are way out of balance compared to other states.

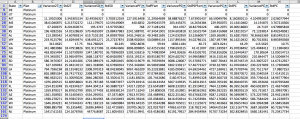

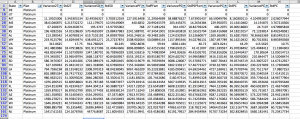

However, for a Platinum plan, has the ninth smallest variation across all rating scenarios. New Jersey, Michigan and Wisconsin have the largest variations.

When I was looking through scenarios myself, the more important use case was annual cost in a couple of scenarios: one person maxes out the deductible, or we max out the whole family deductible. As it turns out, the platinum plans in MN were actually the cheapest in both cases.

And obviously accounting for tax credits would be interesting too, as you note.